Managing finances is an essential aspect of running a successful business. One tool that can help businesses track their financial performance is a Profit And Loss Worksheet. This worksheet allows businesses to analyze their revenue, expenses, and ultimately determine their profitability.

By utilizing a Profit And Loss Worksheet, businesses can easily identify areas where they are performing well and areas that may need improvement. This information can help businesses make informed decisions about budgeting, pricing strategies, and overall financial planning.

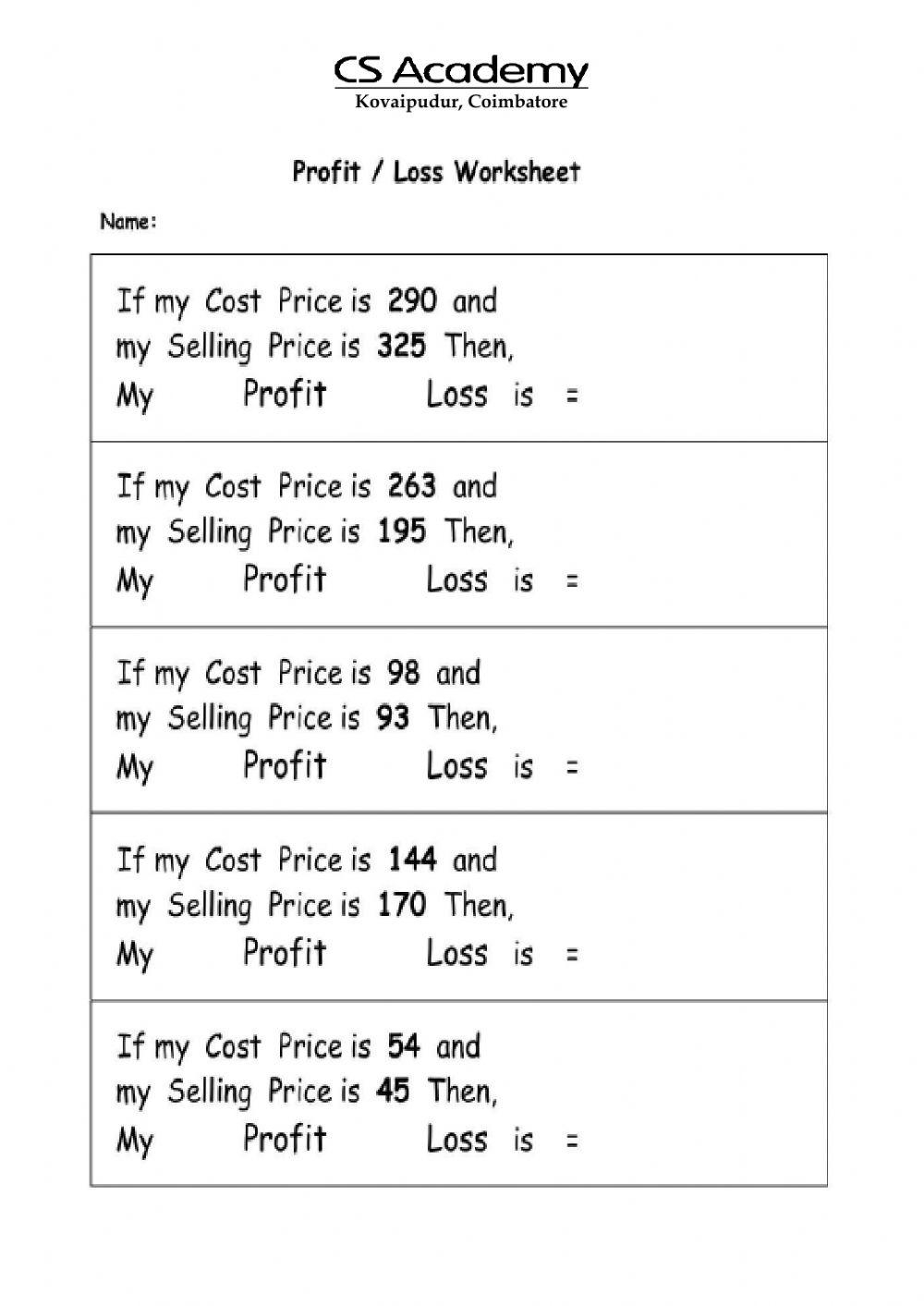

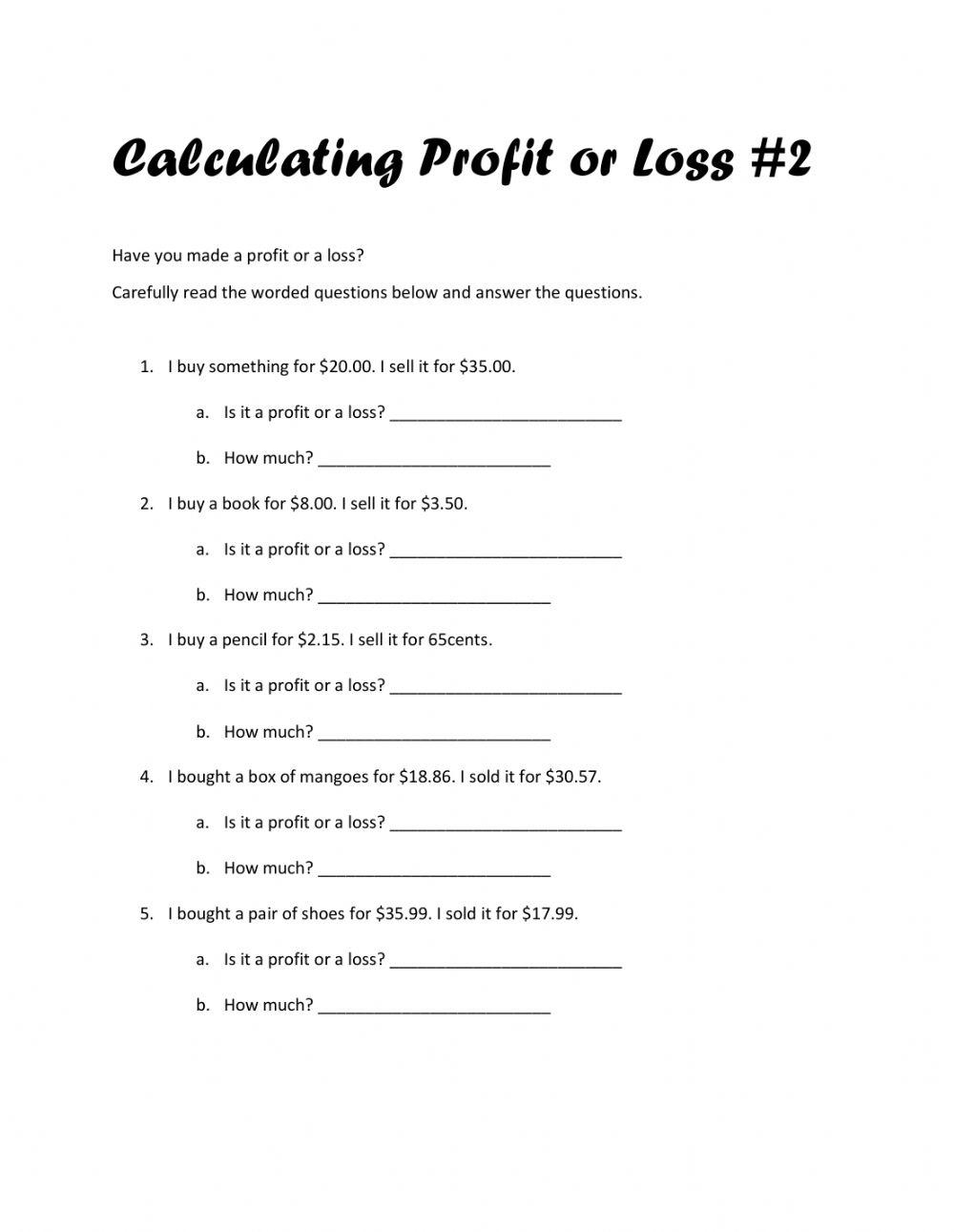

Calculating Profit And Loss 2 Worksheet Live Worksheets Worksheets (worksheets.clipart-library.com)

Calculating Profit And Loss 2 Worksheet Live Worksheets Worksheets (worksheets.clipart-library.com)

Benefits of Using a Profit And Loss Worksheet

One of the key benefits of using a Profit And Loss Worksheet is that it provides a clear overview of a business’s financial health. By tracking revenue and expenses over a specific period, businesses can see if they are operating at a profit or a loss. This information is crucial for making strategic decisions that will impact the long-term success of the business.

Additionally, a Profit And Loss Worksheet can help businesses identify trends in their financial performance. By comparing data from different time periods, businesses can see if their profitability is increasing or decreasing. This insight can help businesses adjust their strategies to maintain or improve their financial performance.

Furthermore, a Profit And Loss Worksheet can help businesses identify areas where they can cut costs or increase revenue. By analyzing expenses and revenue streams, businesses can pinpoint opportunities for improvement and take action to maximize their profitability.

In conclusion, a Profit And Loss Worksheet is a valuable tool for businesses to track their financial performance and make informed decisions about their operations. By regularly updating and analyzing this worksheet, businesses can ensure they are on track to achieve their financial goals and sustain long-term success.