When it comes to planning for retirement, it’s important to understand how your Social Security benefits may be taxed. The Taxable Social Security Worksheet 2024 is a tool used by the IRS to determine if a portion of your benefits are subject to taxation. By familiarizing yourself with this worksheet, you can better prepare for any tax implications that may arise in the future.

As you approach retirement age, it’s crucial to be aware of how your Social Security benefits will be taxed. The Taxable Social Security Worksheet 2024 provides a clear breakdown of how much of your benefits are taxable based on your income level. By utilizing this worksheet, you can calculate your potential tax liability and make informed decisions about your retirement planning.

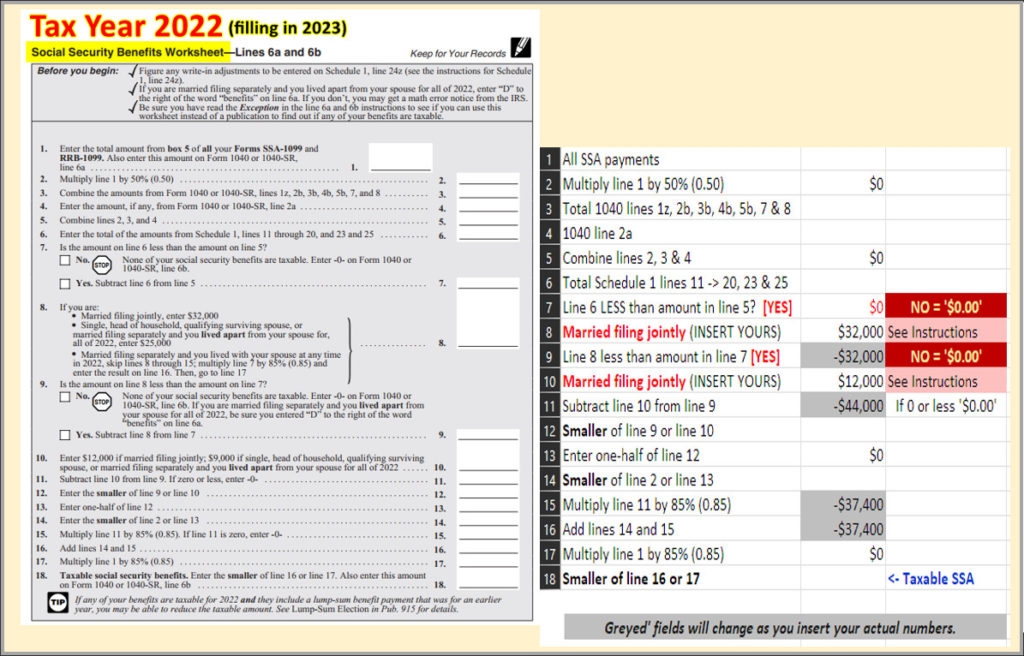

Social Security Benefits Worksheet For Tax Year 2022 A Basic (worksheets.clipart-library.com)

Social Security Benefits Worksheet For Tax Year 2022 A Basic (worksheets.clipart-library.com)

Taxable Social Security Worksheet 2024

The Taxable Social Security Worksheet 2024 takes into account your combined income, which includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits. By following the instructions provided on the worksheet, you can determine the percentage of your benefits that are subject to taxation. This calculation can help you estimate how much of your Social Security income will be taxed and plan accordingly for any potential tax payments.

It’s important to note that not all Social Security benefits are taxable. Depending on your income level, up to 85% of your benefits may be subject to taxation. By carefully filling out the Taxable Social Security Worksheet 2024, you can gain a better understanding of how your benefits will be taxed and take steps to minimize your tax liability.

As you use the Taxable Social Security Worksheet 2024 to calculate your potential tax liability, consider consulting with a financial advisor or tax professional for personalized guidance. They can help you navigate the complexities of Social Security taxation and develop a tax-efficient retirement strategy. By staying informed and proactive, you can make the most of your Social Security benefits in retirement.

In conclusion, the Taxable Social Security Worksheet 2024 is a valuable tool for understanding how your benefits may be taxed in retirement. By utilizing this worksheet and seeking professional advice, you can make informed decisions about your financial future and minimize your tax liability. Take the time to familiarize yourself with the worksheet and plan ahead for any potential tax implications that may arise.