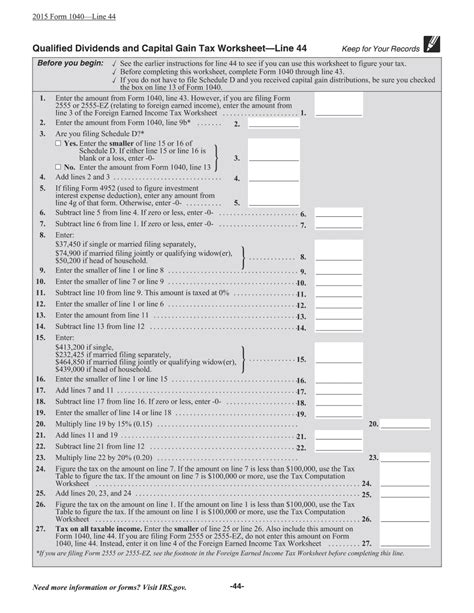

Qualified dividends and capital gains are taxed at a lower rate than ordinary income, making them an attractive investment option for many individuals. However, in order to determine the tax owed on these types of income, taxpayers must fill out the Qualified Dividends and Capital Gain Tax Worksheet.

This worksheet is used in conjunction with Form 1040 or Form 1040A to calculate the tax on qualified dividends and capital gains. It helps to determine the portion of these types of income that are subject to the lower tax rates, as well as any adjustments that may need to be made based on other factors such as deductions and credits.

Qualified Dividends And Capital Gain Tax Worksheet 2017 Worksheet (www.thesecularparent.com)

Qualified Dividends And Capital Gain Tax Worksheet 2017 Worksheet (www.thesecularparent.com)

Qualified Dividends And Capital Tax Worksheet

The worksheet begins by calculating the taxpayer’s total taxable income, including any qualified dividends and capital gains. From there, it subtracts any adjustments to arrive at the adjusted gross income. The worksheet then determines the portion of qualified dividends and capital gains that are eligible for the lower tax rates.

Next, the worksheet factors in any other income, deductions, and credits to arrive at the taxpayer’s total tax liability. This final amount is compared to the tax owed on ordinary income to determine if any additional tax is owed on the qualified dividends and capital gains.

It’s important to note that not all dividends and capital gains qualify for the lower tax rates. In order to be considered qualified, dividends must be paid by a U.S. corporation or a qualified foreign corporation, and capital gains must come from the sale of certain types of assets held for a certain period of time.

Overall, the Qualified Dividends and Capital Gain Tax Worksheet is an essential tool for taxpayers who have received income from dividends and capital gains. By accurately filling out this worksheet, individuals can ensure that they are paying the correct amount of tax on these types of income and taking advantage of the lower tax rates available.

In conclusion, understanding and properly completing the Qualified Dividends and Capital Gain Tax Worksheet is crucial for individuals who receive income from dividends and capital gains. By following the instructions provided and consulting with a tax professional if needed, taxpayers can effectively calculate their tax liability on these types of income and maximize their tax savings.