Managing finances is a crucial aspect of running a successful business. One of the key tools for tracking financial performance is using an Excel sheet for profit and loss calculations. This allows businesses to monitor their revenue and expenses, analyze their financial health, and make informed decisions for future growth.

With an Excel sheet, businesses can input their income and expenses data to generate a profit and loss statement. This statement provides a clear overview of the company’s financial performance over a specific period, typically monthly, quarterly, or annually. By tracking these metrics, businesses can identify areas of improvement, cut costs, or increase revenue to boost profitability.

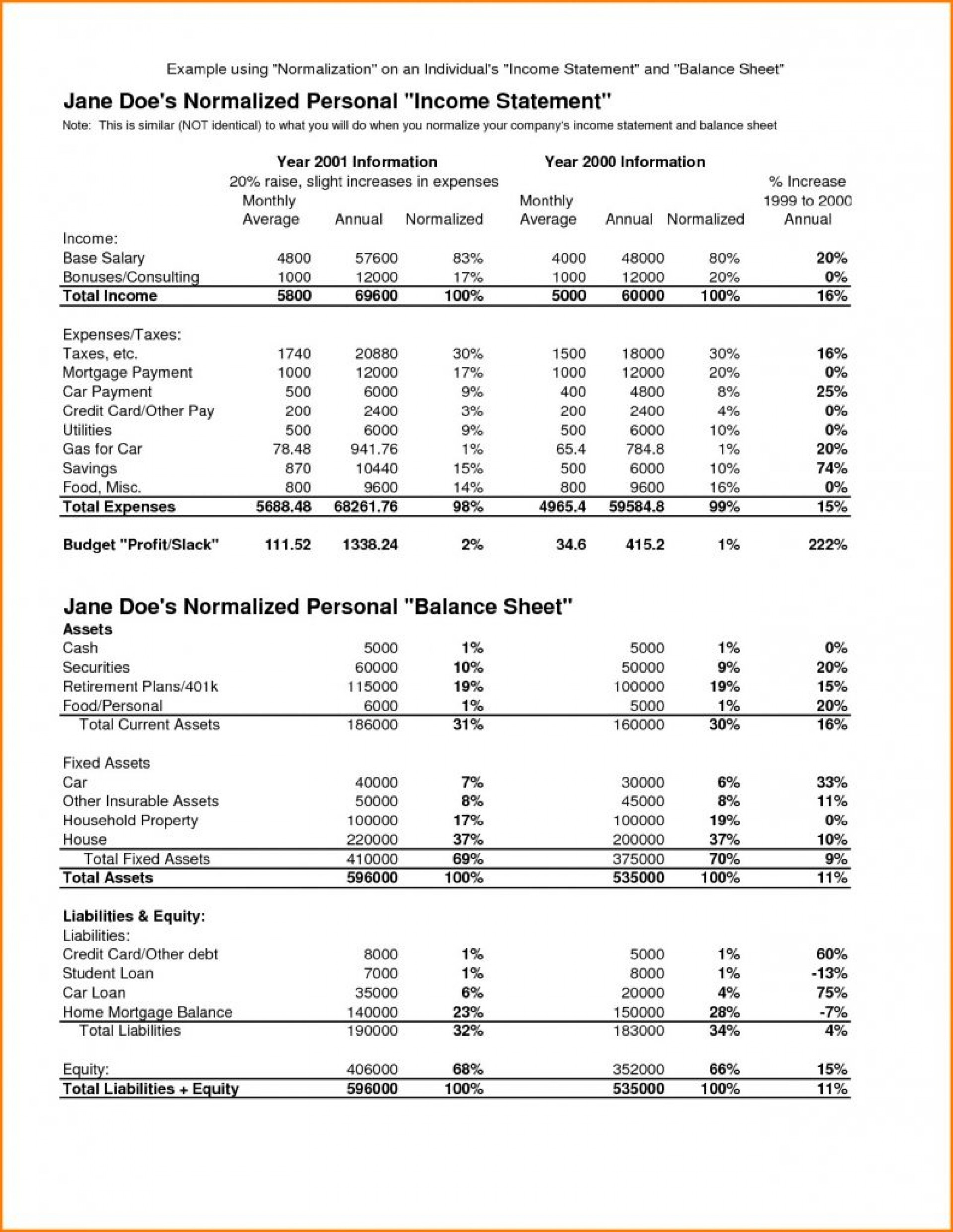

Profit And Loss Excel Spreadsheet Db Excel (db-excel.com)

Profit And Loss Excel Spreadsheet Db Excel (db-excel.com)

Excel sheets offer a high level of customization, allowing businesses to tailor their profit and loss statements to meet their specific needs. Users can create formulas, charts, and graphs to visualize their financial data and gain insights into key performance indicators. This level of detail helps businesses make strategic decisions and plan for long-term success.

Furthermore, Excel sheets provide the flexibility to update and modify financial data as needed. Businesses can easily add new income streams, adjust expenses, or forecast future revenues to see how these changes impact their bottom line. This real-time data tracking is essential for adapting to market fluctuations and staying competitive in today’s fast-paced business environment.

In conclusion, Excel sheets are a valuable tool for businesses to track their profit and loss, analyze financial performance, and make data-driven decisions. By utilizing the customizable features of Excel, businesses can gain a deeper understanding of their financial health and take proactive steps to improve profitability. With the right tools and strategies in place, businesses can achieve sustainable growth and success in the long run.