When it comes to taxes, understanding the different types of income and how they are taxed is crucial. Qualified dividends and capital gains are two types of income that are taxed at a lower rate than ordinary income. Knowing how to calculate the tax on these types of income can help you minimize your tax liability and keep more of your hard-earned money.

Qualified dividends are dividends paid by a U.S. corporation or a qualified foreign corporation. These dividends are taxed at the capital gains tax rates, which are typically lower than ordinary income tax rates. Capital gains, on the other hand, are profits from the sale of assets such as stocks, bonds, or real estate. Like qualified dividends, capital gains are also taxed at lower rates than ordinary income.

Qualified Dividends And Capital Gain Tax Worksheet For 2023 A (worksheets.clipart-library.com)

Qualified Dividends And Capital Gain Tax Worksheet For 2023 A (worksheets.clipart-library.com)

Qualified Dividends And Capital Gain Tax Worksheet

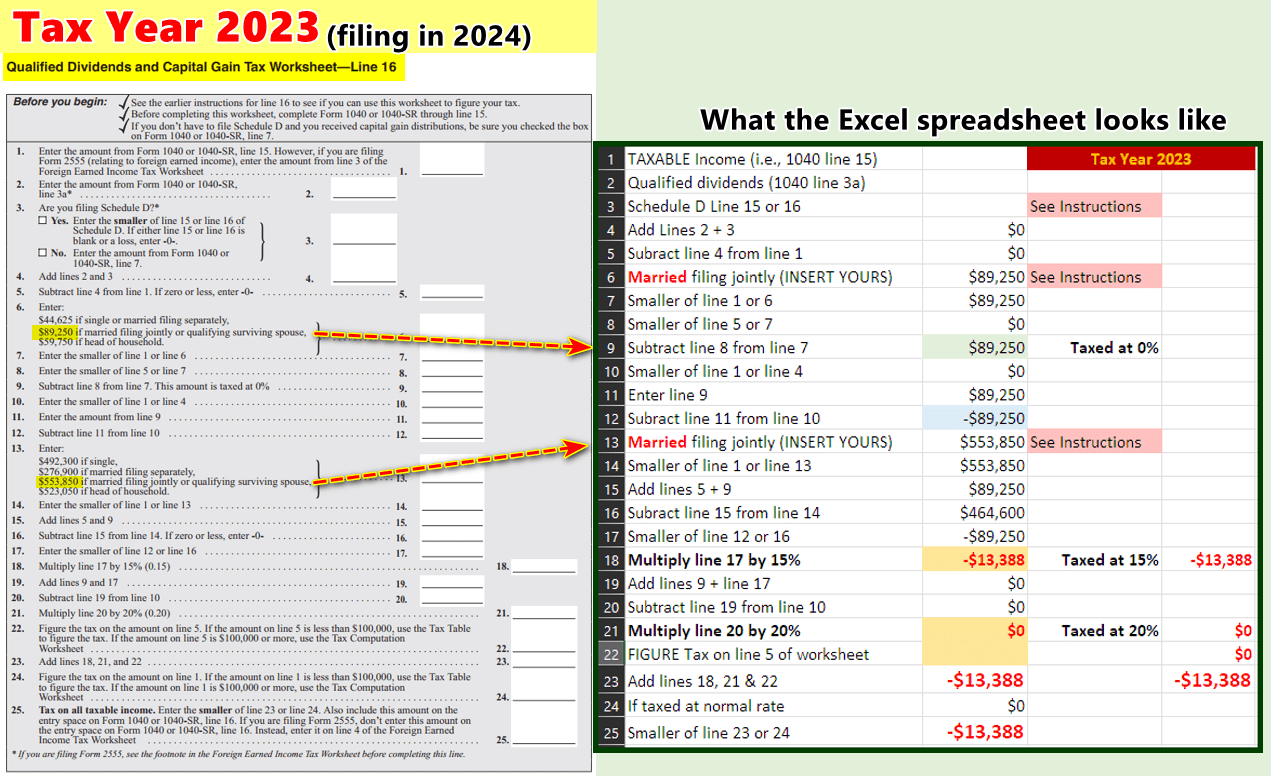

One way to calculate the tax on qualified dividends and capital gains is to use the Qualified Dividends and Capital Gain Tax Worksheet. This worksheet helps you determine the amount of tax you owe on these types of income based on your filing status and total income.

The worksheet takes into account your ordinary income, qualified dividends, and net capital gains to determine your tax liability. By following the instructions on the worksheet and filling in the appropriate information, you can easily calculate the tax on your qualified dividends and capital gains.

It’s important to note that not all dividends are considered qualified dividends, and not all capital gains are taxed at the lower rates. To be considered qualified, dividends must meet certain requirements, such as being paid by a U.S. corporation or a qualified foreign corporation. Similarly, not all capital gains are eligible for the lower tax rates, so it’s essential to understand the rules and guidelines for each type of income.

Using the Qualified Dividends and Capital Gain Tax Worksheet can help you accurately calculate the tax on your qualified dividends and capital gains, ensuring that you pay the correct amount and avoid any penalties or fines. By staying informed and utilizing the resources available, you can make the most of these lower tax rates and keep more of your investment income.

In conclusion, the Qualified Dividends and Capital Gain Tax Worksheet is a valuable tool for calculating the tax on these types of income. By understanding the rules and guidelines for qualified dividends and capital gains, you can take advantage of the lower tax rates and minimize your tax liability. Make sure to consult with a tax professional or use tax software to ensure that you are accurately calculating the tax on your investment income.