When it comes to investing in the stock market, it is important to understand the tax implications of your investments. One key aspect to consider is whether your dividends and capital gains are qualified or not. Qualified dividends and capital gains are subject to lower tax rates compared to ordinary dividends and capital gains. This can result in significant tax savings for investors.

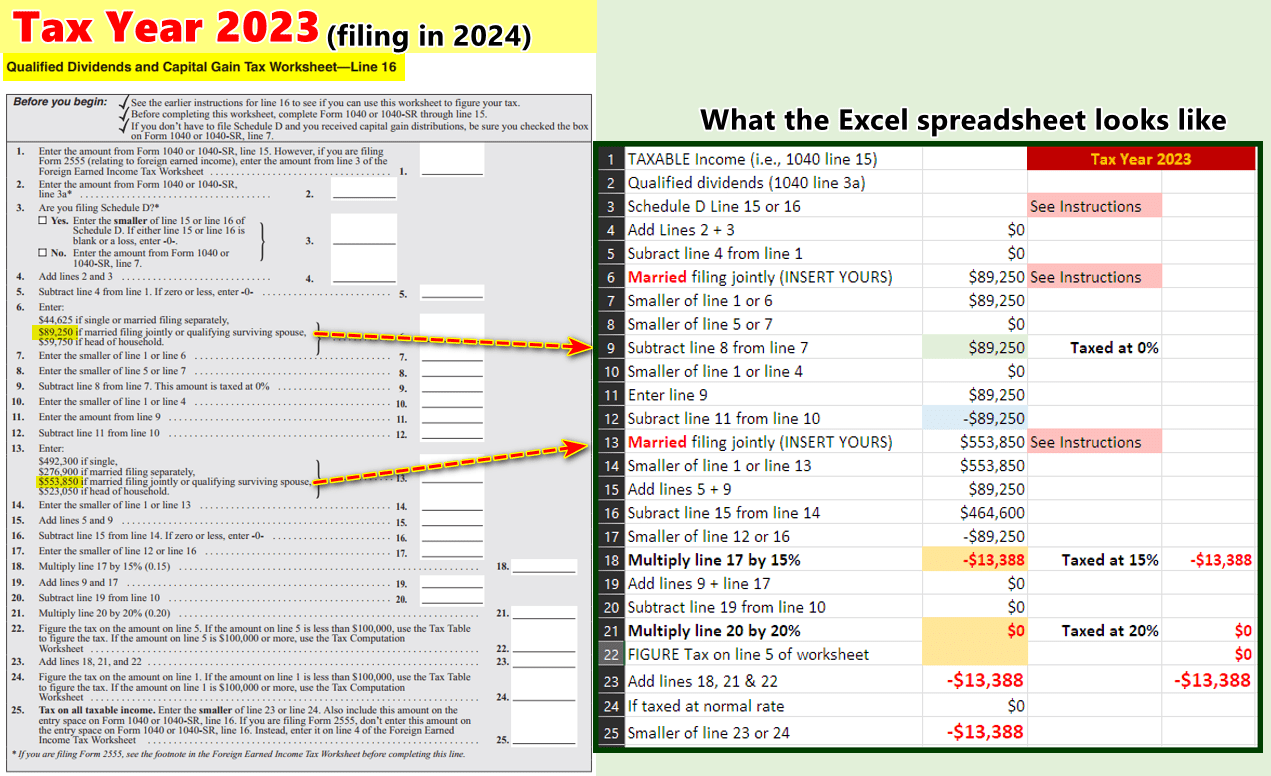

Investors can use the Qualified Dividends and Capital Gains Worksheet to calculate the amount of qualified dividends and capital gains they have received during the tax year. This worksheet helps determine the tax rate that will apply to these types of income, which can vary based on an individual’s tax bracket.

Qualified Dividends And Capital Gain Tax Worksheet 2017 Worksheet (www.thesecularparent.com)

Qualified Dividends And Capital Gain Tax Worksheet 2017 Worksheet (www.thesecularparent.com)

Qualified Dividends And Capital Gains Worksheet

The Qualified Dividends and Capital Gains Worksheet starts by calculating your total capital gains and qualified dividends. These figures are then used to determine your adjusted net capital gain, which is the amount that is eligible for the lower tax rates. The worksheet also takes into account any other income you may have, which can affect the tax treatment of your qualified dividends and capital gains.

Once you have completed the worksheet and determined your adjusted net capital gain, you can use the tax rate schedule provided by the IRS to calculate the amount of tax you owe on your qualified dividends and capital gains. It is important to accurately complete the worksheet to ensure that you are taking advantage of the lower tax rates available for qualified dividends and capital gains.

By utilizing the Qualified Dividends and Capital Gains Worksheet, investors can potentially reduce their tax liability and keep more of their investment returns. This tool provides a clear and systematic way to calculate the tax treatment of qualified dividends and capital gains, helping investors make informed decisions about their investments.

In conclusion, understanding and utilizing the Qualified Dividends and Capital Gains Worksheet can be beneficial for investors looking to maximize their investment returns while minimizing their tax burden. By accurately calculating and reporting your qualified dividends and capital gains, you can take advantage of the lower tax rates available for these types of income, ultimately helping you achieve your financial goals.