When you sell an investment for less than you paid for it, you incur a capital loss. This loss can be used to offset any capital gains you may have, reducing the amount of taxes you owe. However, if your capital losses exceed your capital gains in a given year, you can carry over the excess loss to future years using a Capital Loss Carryover Worksheet.

The Capital Loss Carryover Worksheet is a tool provided by the IRS to help you keep track of any unused capital losses that can be carried over to future years. This worksheet helps you determine the amount of capital loss you can deduct in a given year and how much can be carried forward to offset capital gains in future years.

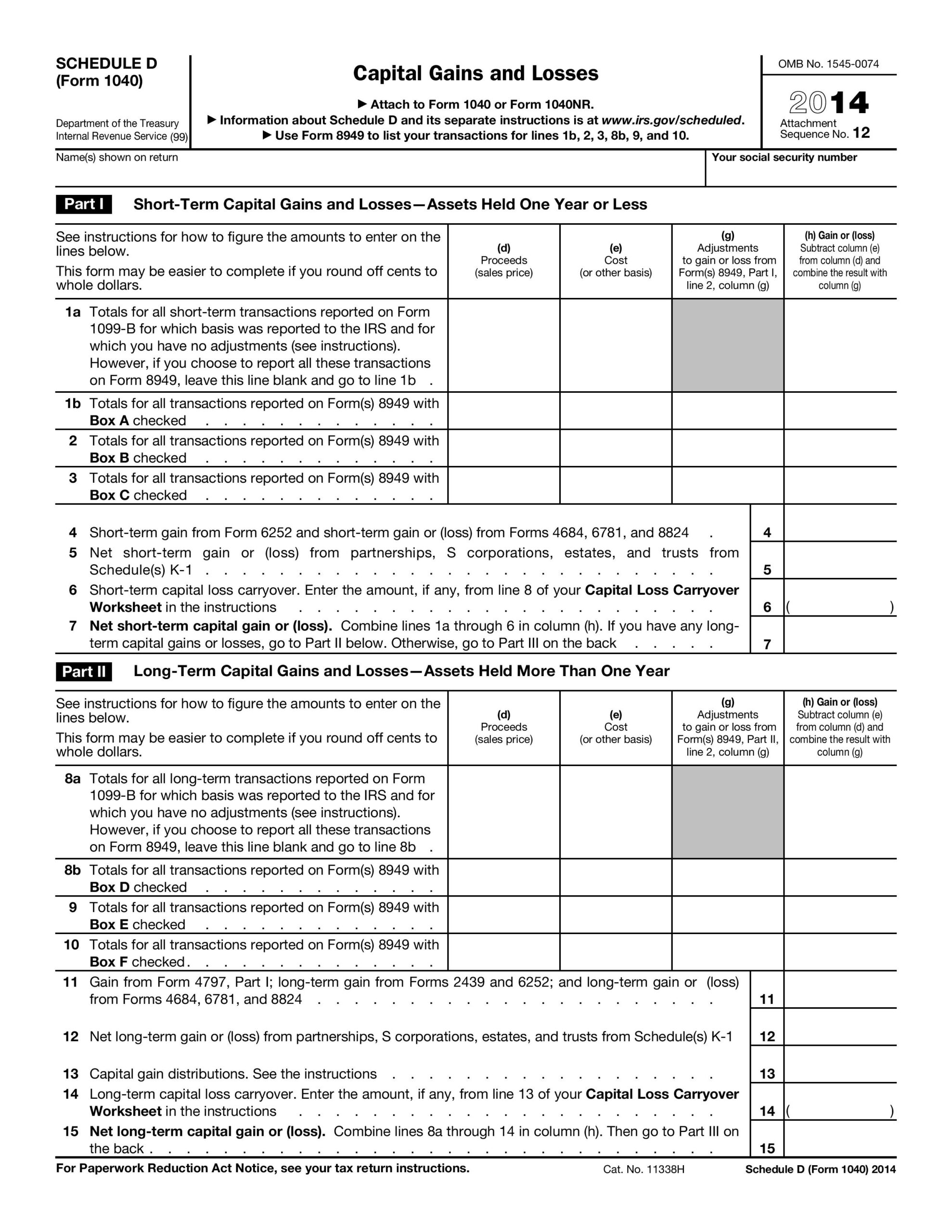

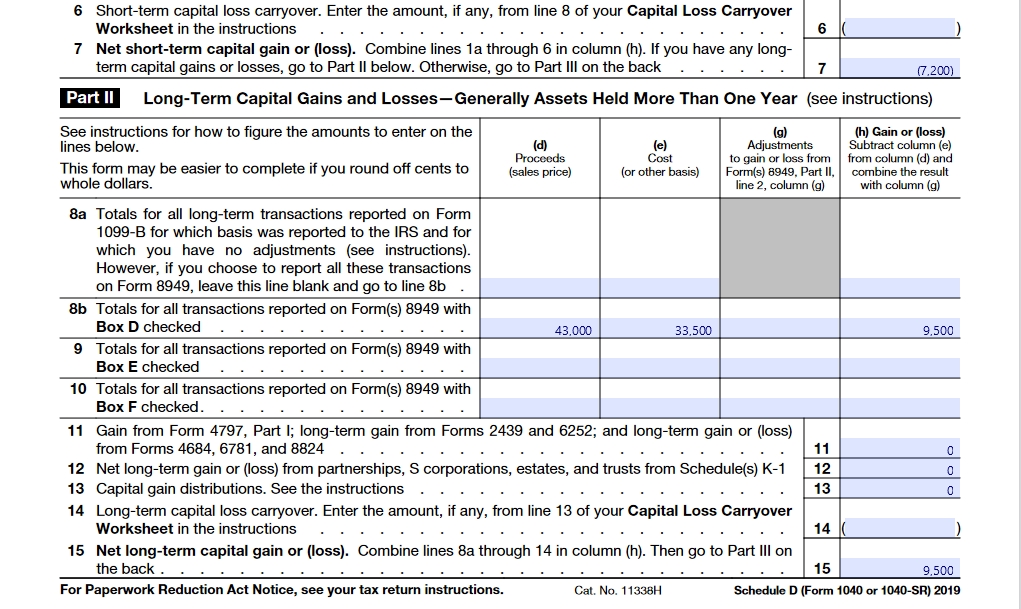

6 6 Short Term Capital Loss Carryover Enter The Chegg (worksheets.clipart-library.com)

6 6 Short Term Capital Loss Carryover Enter The Chegg (worksheets.clipart-library.com)

When completing the Capital Loss Carryover Worksheet, you will need to gather information such as the amount of capital losses incurred in previous years, any capital gains realized in the current year, and any capital losses incurred in the current year. By inputting these figures into the worksheet, you can calculate the amount of capital loss that can be carried over to future years.

It is important to keep track of your capital losses and use the Capital Loss Carryover Worksheet to ensure you are maximizing your tax benefits. By carrying over unused capital losses, you can potentially reduce your tax liability in future years when you have capital gains to offset.

Remember that the rules for capital loss carryovers can be complex, so it is recommended to consult with a tax professional or financial advisor for guidance on how to properly utilize the Capital Loss Carryover Worksheet and maximize your tax savings.

In conclusion, the Capital Loss Carryover Worksheet is a valuable tool for managing and maximizing the tax benefits of capital losses. By keeping track of your losses and utilizing this worksheet, you can potentially reduce your tax liability and optimize your overall financial situation. Be sure to stay informed and seek professional advice to make the most of this tax-saving opportunity.