Debt can be a significant burden on anyone’s financial well-being. However, with the right tools and strategies, it is possible to tackle and eliminate debt effectively. One popular method that has helped many people become debt-free is the debt snowball worksheet. This worksheet is a simple yet powerful tool that can help individuals prioritize and pay off their debts systematically.

By following the debt snowball method, individuals can start by paying off their smallest debt first, while making minimum payments on all other debts. Once the smallest debt is paid off, the individual can then roll that payment amount into the next smallest debt. This process continues until all debts are paid off, creating momentum and motivation along the way.

A Printable Debt Snowball Worksheet Is Shown In This Image It Shows The (www.pinterest.com.au)

A Printable Debt Snowball Worksheet Is Shown In This Image It Shows The (www.pinterest.com.au)

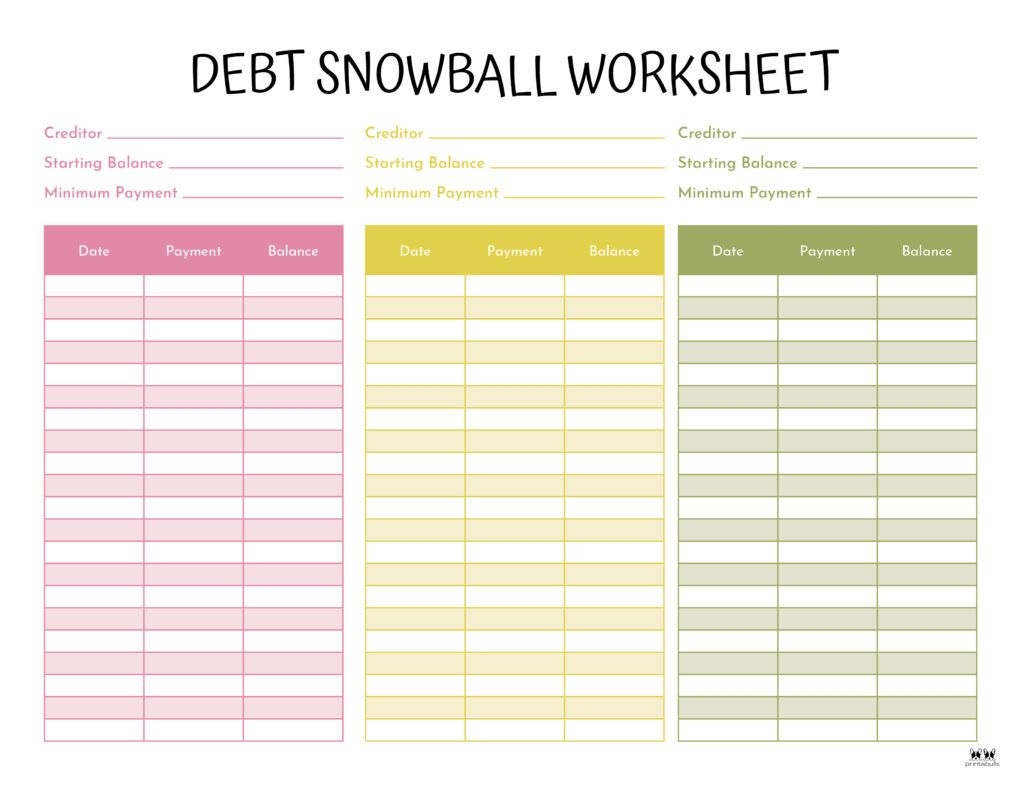

Debt Snowball Worksheet

The debt snowball worksheet typically includes a list of all debts, their respective balances, minimum payments, and interest rates. It also helps individuals track their progress as they pay off each debt. By visually seeing their progress, individuals can stay motivated and focused on their goal of becoming debt-free.

Using a debt snowball worksheet can also help individuals make informed decisions about their finances. It allows them to see which debts to prioritize based on interest rates and balances. This strategic approach can save money in the long run by focusing on high-interest debts first.

Furthermore, the debt snowball worksheet promotes a sense of accomplishment with each debt paid off. This sense of achievement can boost confidence and encourage individuals to stick to their debt repayment plan. As debts are eliminated one by one, individuals can experience financial freedom and peace of mind.

In conclusion, the debt snowball worksheet is a valuable tool for anyone looking to get out of debt and improve their financial situation. By following this method and using the worksheet to track progress, individuals can take control of their debts and work towards a debt-free future. With determination and discipline, anyone can use the debt snowball worksheet to achieve financial freedom.