When it comes to understanding the financial health of a business, being able to calculate percentage profit and loss is crucial. This helps businesses determine how well they are performing and make informed decisions about their future strategies. A percentage profit and loss worksheet is a useful tool that can help businesses track their financial performance over time.

By using a percentage profit and loss worksheet, businesses can easily calculate their profit margins and identify areas where they may be losing money. This can help them make adjustments to their pricing or cost structure to improve their profitability. It also allows businesses to compare their performance to industry averages and benchmarks to see how they stack up against their competitors.

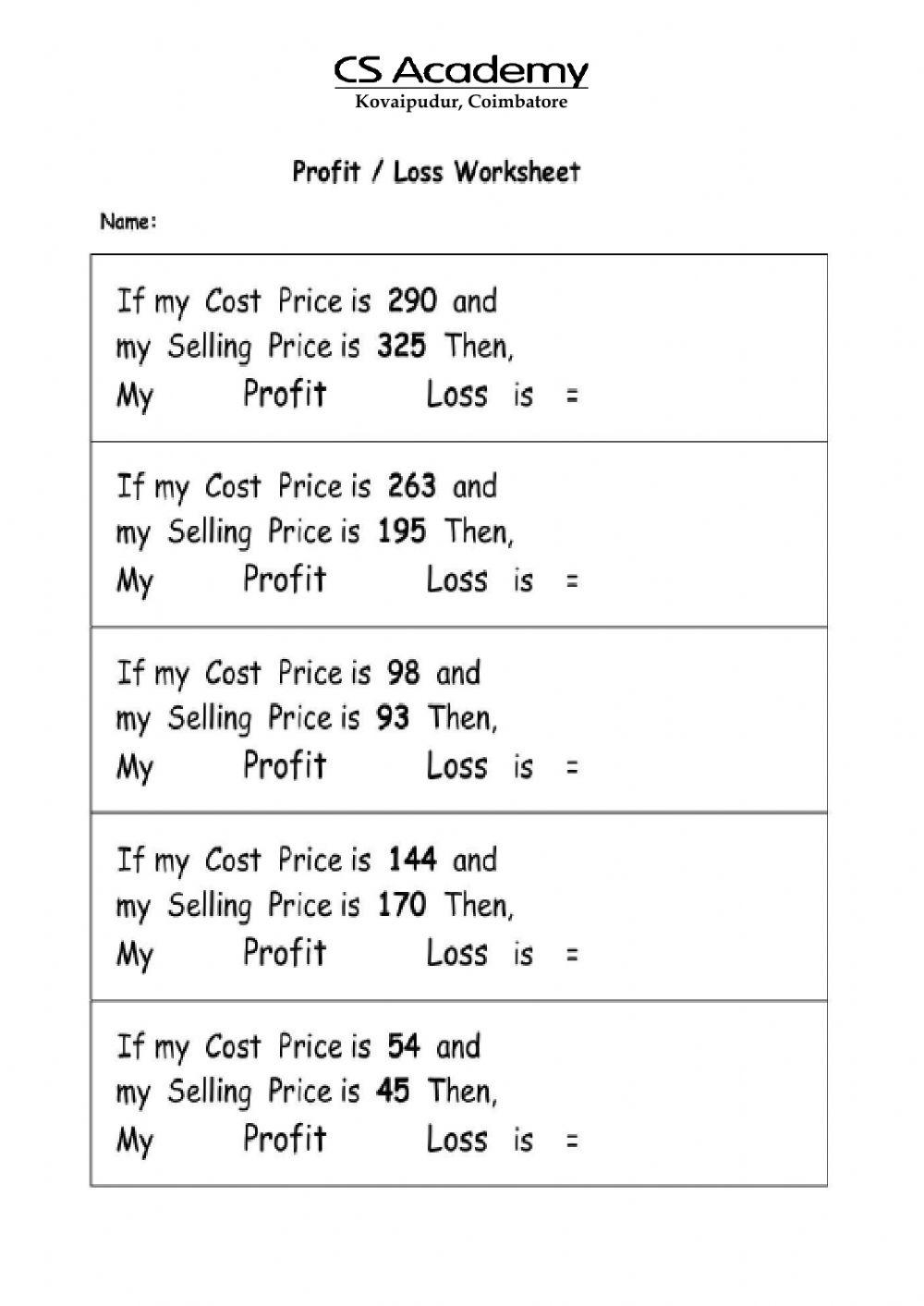

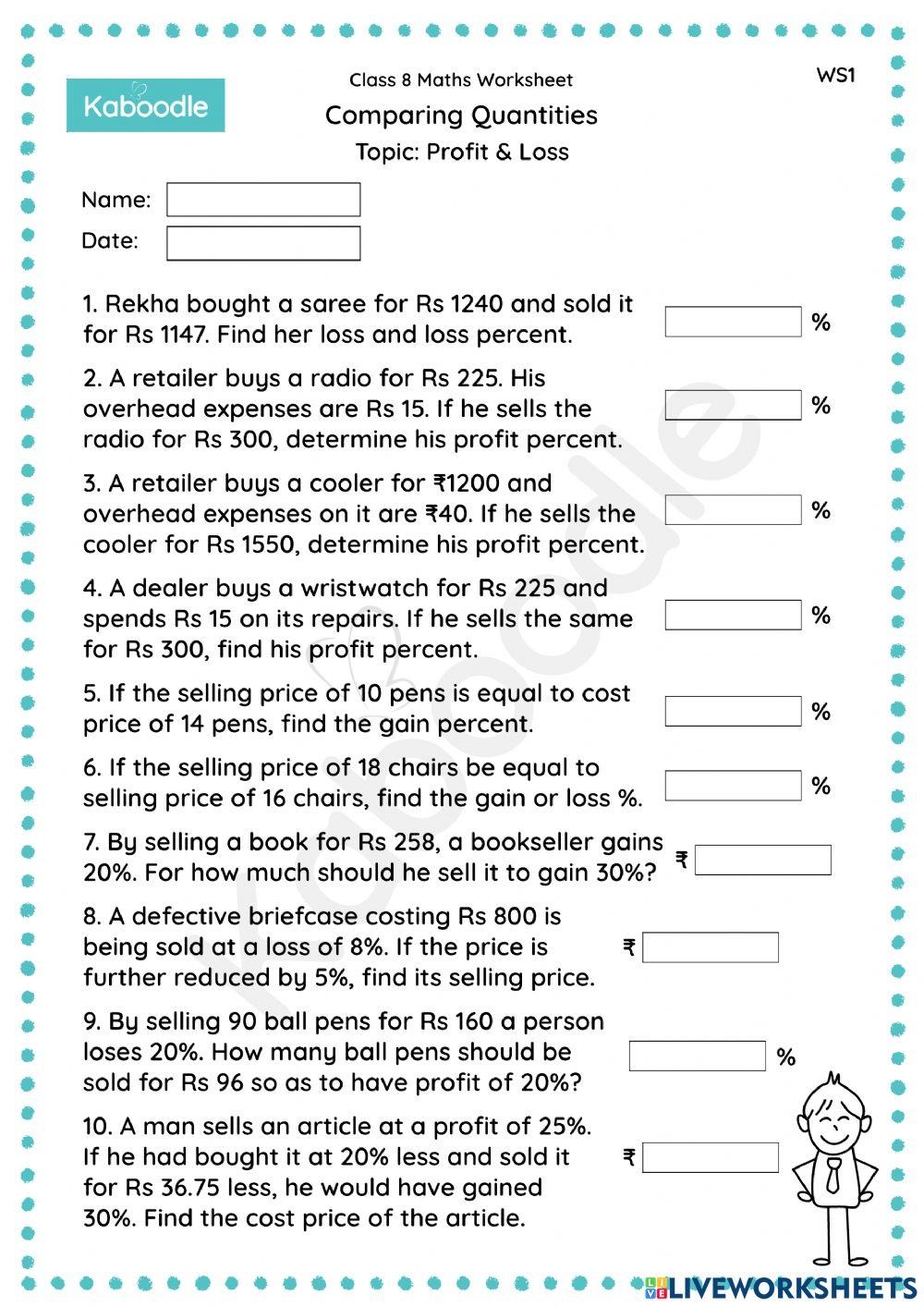

Free Profit And Loss Worksheet Download Free Profit And Loss Worksheet (worksheets.clipart-library.com)

Free Profit And Loss Worksheet Download Free Profit And Loss Worksheet (worksheets.clipart-library.com)

One key component of a percentage profit and loss worksheet is the calculation of gross profit margin. This is calculated by dividing the gross profit (revenue minus cost of goods sold) by the revenue and then multiplying by 100 to get a percentage. This can help businesses understand how efficiently they are producing their goods or services and how much profit they are generating from each sale.

Another important calculation on a percentage profit and loss worksheet is the net profit margin. This is calculated by dividing the net profit (revenue minus all expenses) by the revenue and then multiplying by 100. This percentage indicates how much of each dollar of revenue is actually profit after all expenses have been accounted for.

Using a percentage profit and loss worksheet can help businesses identify opportunities for growth and improvement. By regularly tracking their financial performance and analyzing their profit and loss margins, businesses can make data-driven decisions that can lead to increased profitability and long-term success.

In conclusion, a percentage profit and loss worksheet is a valuable tool for businesses looking to assess their financial performance and make informed decisions about their future strategies. By calculating important metrics such as gross profit margin and net profit margin, businesses can gain valuable insights into their profitability and make adjustments to improve their bottom line.