When it comes to managing your finances, it is important to keep track of all your expenses and deductions to ensure you are maximizing your tax savings. A deductions worksheet is a tool that helps individuals organize and calculate their deductions, which can include expenses such as medical bills, charitable contributions, and business expenses.

By using a deductions worksheet, individuals can easily keep track of their deductible expenses throughout the year, making it easier to file their taxes accurately and efficiently. This tool can help individuals identify potential deductions they may have overlooked and ensure they are taking advantage of all available tax breaks.

Income Tax Deductions Income Tax Deductions Worksheet Db Excel (db-excel.com)

Income Tax Deductions Income Tax Deductions Worksheet Db Excel (db-excel.com)

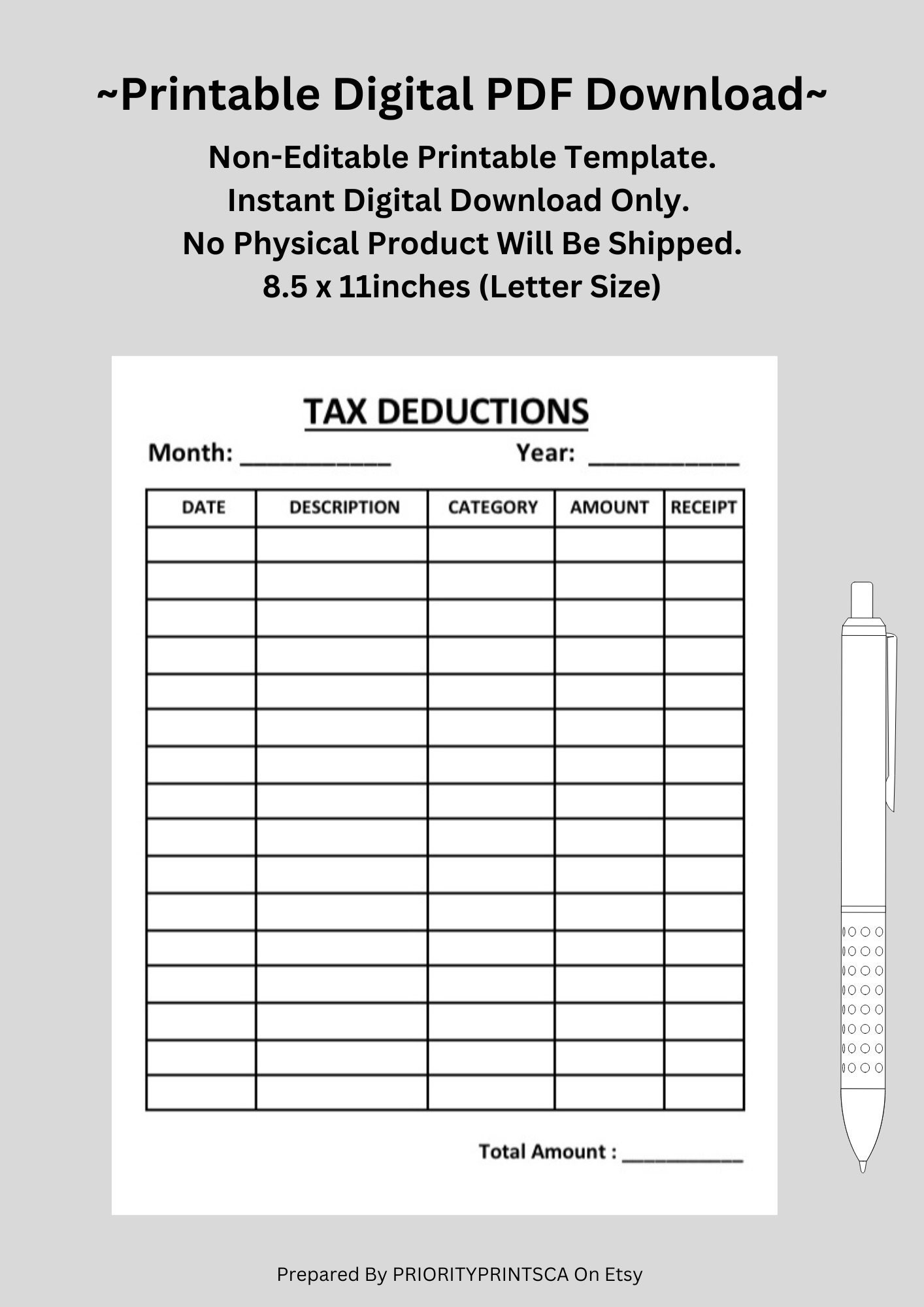

Deductions Worksheet

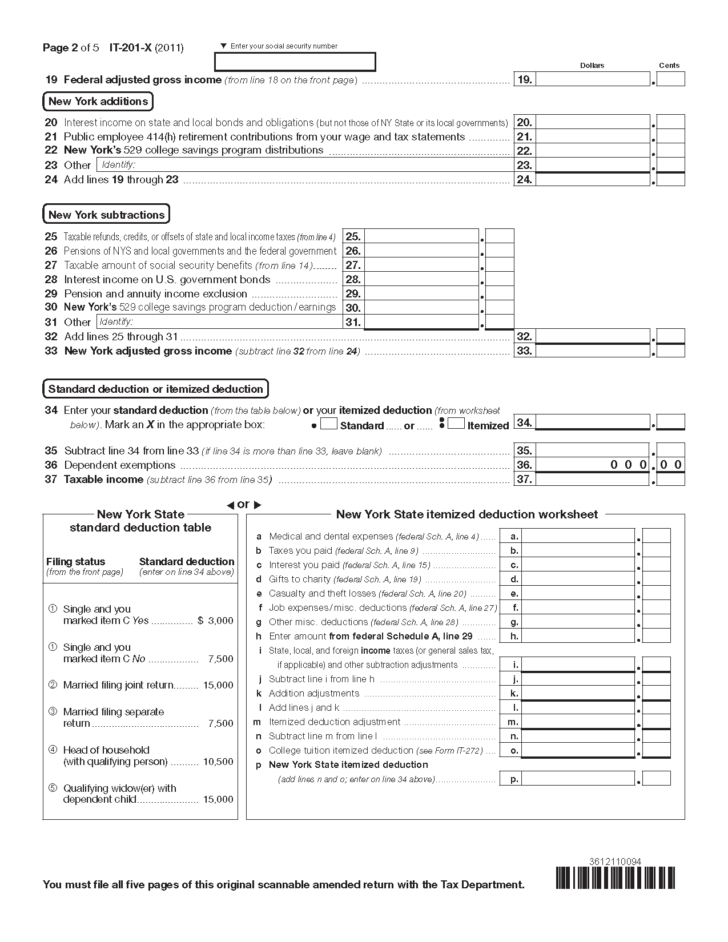

A deductions worksheet typically includes categories for various types of deductible expenses, such as medical expenses, mortgage interest, property taxes, charitable contributions, and business expenses. Individuals can input their expenses into the appropriate categories and calculate the total amount of deductions they are eligible for.

It is important to keep detailed records and receipts of all deductible expenses to support your claims in case of an audit. Using a deductions worksheet can help you stay organized and ensure you have all the necessary documentation to back up your deductions.

Additionally, a deductions worksheet can be a valuable tool for planning ahead and making strategic financial decisions. By tracking your deductible expenses throughout the year, you can identify areas where you may be able to reduce costs and increase your tax savings.

In conclusion, a deductions worksheet is a useful tool for individuals looking to maximize their tax savings and stay organized when it comes to managing their finances. By keeping track of deductible expenses and using this tool to calculate your deductions, you can ensure you are taking full advantage of all available tax breaks and minimizing your tax liability.