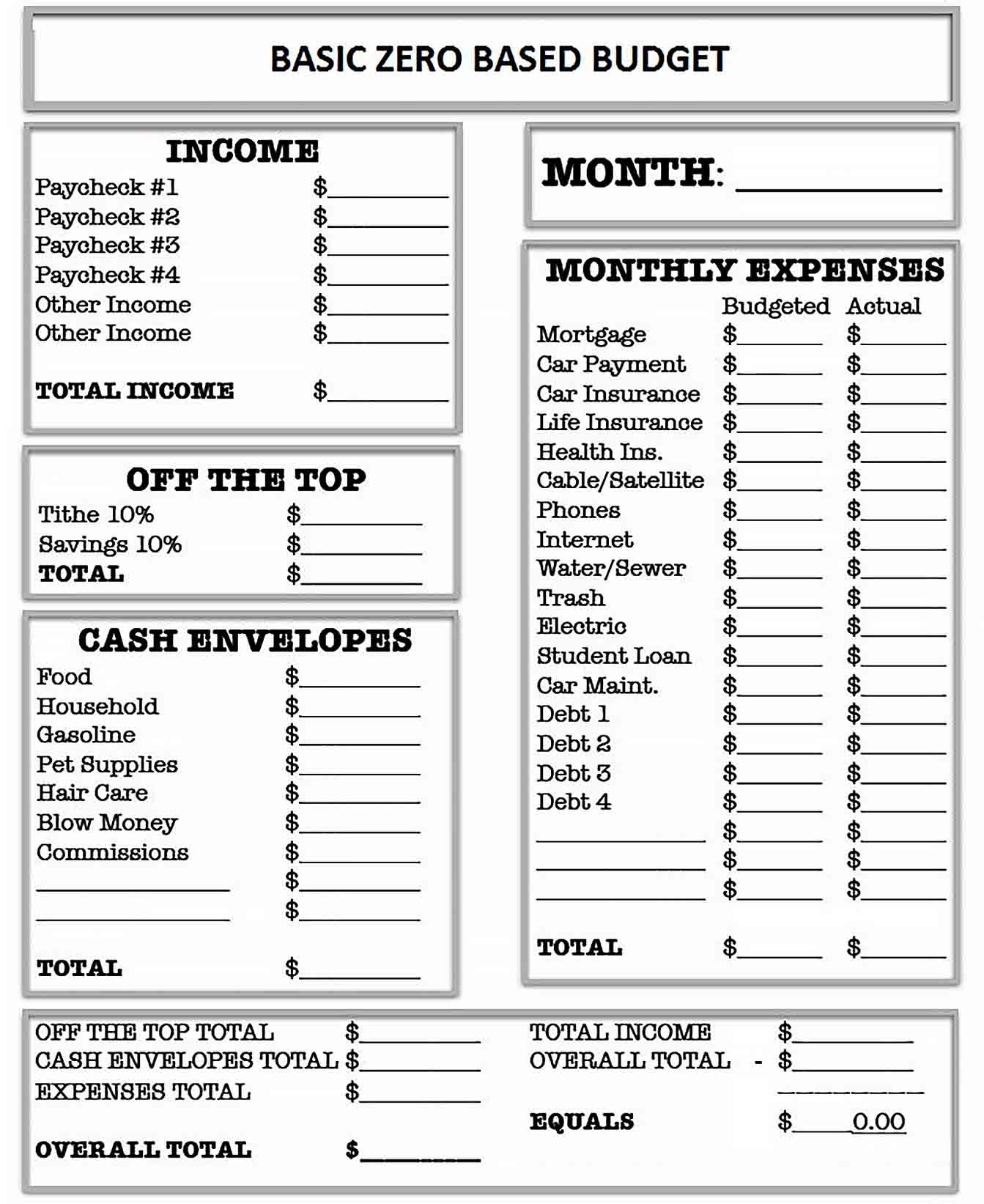

Creating a budget is essential for managing your finances and achieving your financial goals. However, many people struggle with budgeting because they don’t have a clear understanding of their income and expenses. This is where budgeting worksheets can be incredibly helpful.

These worksheets provide a structured way to track your income, expenses, and savings, making it easier to see where your money is going and where you can make adjustments. By using budgeting worksheets, you can take control of your finances and make informed decisions about your spending.

Budgeting Math Worksheets Pdf Budgeting Worksheets (budgeting-worksheets.com)

Budgeting Math Worksheets Pdf Budgeting Worksheets (budgeting-worksheets.com)

Benefits of Budgeting Worksheets

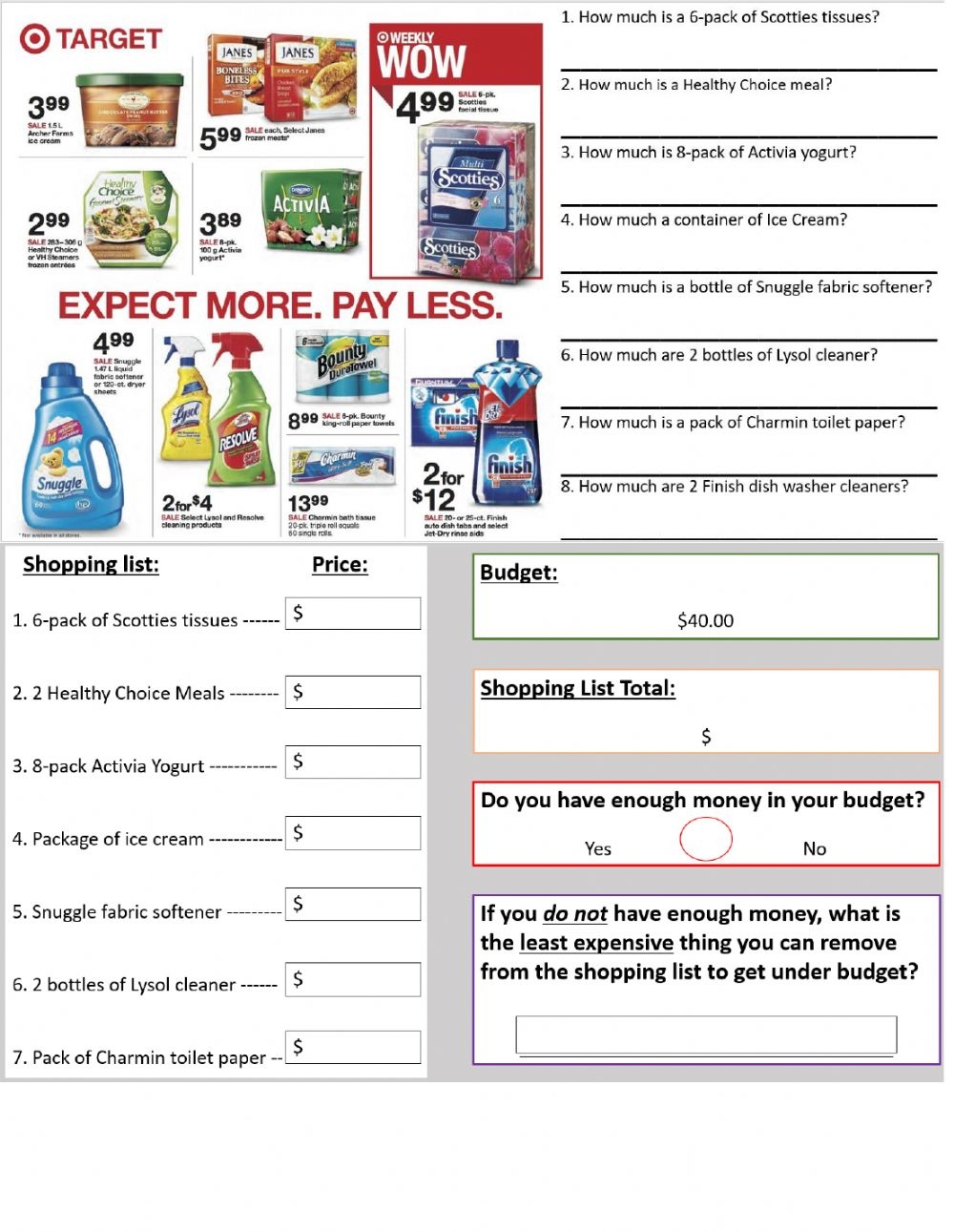

One of the main benefits of using budgeting worksheets is that they help you visualize your financial situation. By inputting your income and expenses into a worksheet, you can see how much money you have coming in and going out each month. This can help you identify areas where you may be overspending and make changes to your budget accordingly.

Additionally, budgeting worksheets can help you set and track financial goals. Whether you’re saving for a vacation, a new car, or a down payment on a house, a budgeting worksheet can help you track your progress and stay on target. By regularly updating your worksheet, you can see how close you are to reaching your goals and make adjustments as needed.

Another benefit of budgeting worksheets is that they can help you prepare for unexpected expenses. By having a clear picture of your finances, you can set aside money each month for emergencies or unexpected costs. This can help you avoid going into debt when unexpected expenses arise, giving you peace of mind knowing that you have a financial safety net in place.

In conclusion, budgeting worksheets are a valuable tool for managing your finances and achieving your financial goals. By using these worksheets, you can gain a better understanding of your income and expenses, set and track financial goals, and prepare for unexpected expenses. With a clear picture of your finances, you can take control of your money and make informed decisions about your spending.