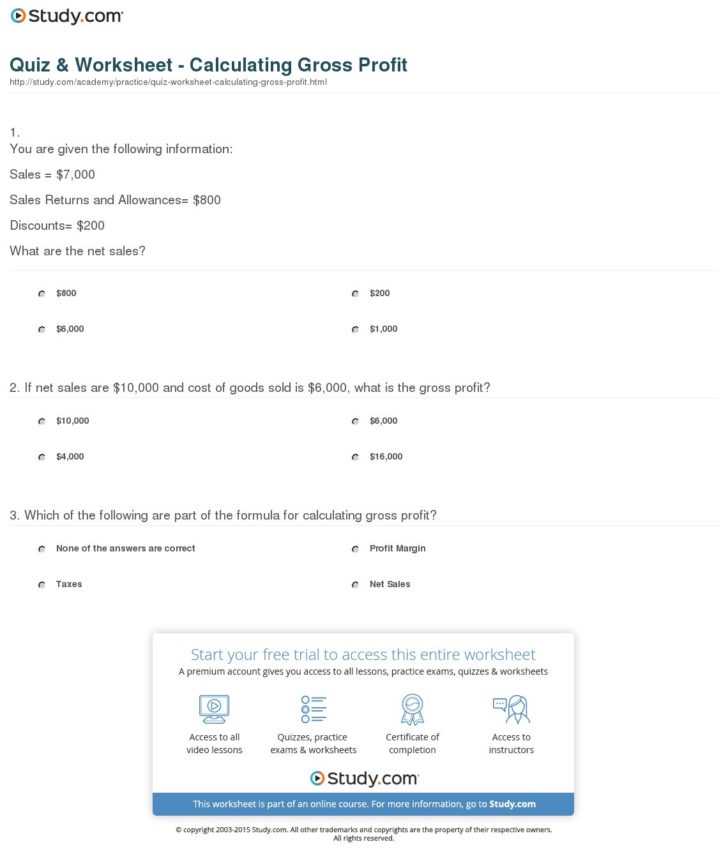

Calculating gross profit is an essential aspect of running a successful business. It helps you determine how much money you are making after deducting the cost of goods sold. A gross profit worksheet is a tool that can help you track and calculate this important financial metric.

By using a gross profit worksheet, businesses can easily analyze their revenue and expenses to determine their overall profitability. This worksheet typically includes information such as sales revenue, cost of goods sold, and gross profit margin. It provides a clear picture of the financial health of the business and can help identify areas for improvement.

EDEXCEL GCSE Business 2 4 1 Gross And Net Profit Practice Questions (www.tes.com)

EDEXCEL GCSE Business 2 4 1 Gross And Net Profit Practice Questions (www.tes.com)

When filling out a gross profit worksheet, it is important to accurately record all relevant financial information. This includes the total sales revenue generated during a specific period, the cost of goods sold, and any other expenses directly related to the production of goods or services. By subtracting the cost of goods sold from the total revenue, you can calculate the gross profit margin.

Businesses can use the information gathered from a gross profit worksheet to make informed decisions about pricing, inventory management, and overall financial planning. It can also help identify any inefficiencies in the production process or areas where costs can be reduced to improve profitability.

In conclusion, a gross profit worksheet is a valuable tool for businesses to track their financial performance and make informed decisions. By accurately calculating and analyzing gross profit, businesses can identify opportunities for growth and improve their overall profitability.